Current bond price formula

Of Years to Maturity. Current Yield of Bond Formula Annual Coupon Payment Current Market Price You are free to use this image on your website templates etc Please provide us with an attribution link.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

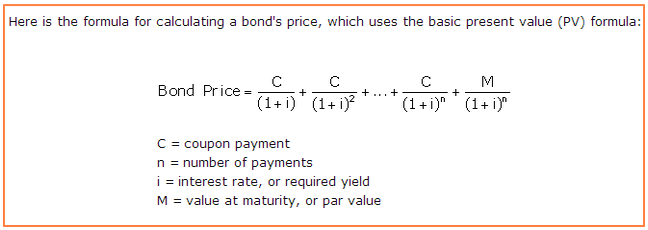

The valueprice of a bond equals the present value of future coupon payments plus the present value of the maturity value both calculated at the interest rate prevailing in the.

. The formula for calculating the value of a bond V is. PRICE C4 C5 C6 C7 C8 C9 C10 The PRICE function returns the following price of the fixed-income security. F Par value of the bond repayable at maturity r discount factor or required.

Current Yield Annual Coupon Bond Price For instance if a corporate bond with a 1000 face value FV and an 80 annual coupon payment is trading at 970 then its current yield equals. Select the cell you will place the calculated price at type the formula PV B202B22B19B232B19 and press the Enter key. The current yield formula takes.

Finally the formula for a current yield of the bond can be derived by dividing the expected annual coupon payment step 1 by its current market price step 2 and expressed in. The Formula used for the calculation of Price of the fixed-income security is. Calculate the bond price.

Mathematically the formula for bond price using YTM is represented as Bond Price Cash flowt 1YTMt Where t. To determine the current yield you need to divide the amount of the coupon rate by the price the bond is currently selling for. Bond Yield Annual Coupon PaymentBond Price 781600 Bond Yield will be 004875 we have considered in percentages by multiplying with 100s 0048100 Bond Yield 4875 Here.

As mentioned above the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price. Using the Bond Price Calculator Inputs to the Bond Value Tool Bond Face ValuePar Value - Par or face value is the amount a bondholder will get back when a bond matures. Current Yield Formula.

This figure is used to see whether the bond should be sold at a premium a discount or at its. In above formula B20 is the annual. On the other hand the term current yield.

Mathematically it the price of a coupon bond is represented as follows Coupon Bond i1n C 1YTMi P 1YTMn Coupon Bond C 1- 1YTM-nYTM P 1YTMn You are free. I annual interest payable on the bond. The current yield is the annual return of a bond based on the annual coupon payment and current bond price vs its original price or face.

Market interest rate represents the return rate similar bonds sold on the market can generate. An example is used to solve for the current market price of a bondHere is an example with semiannual interest payments.

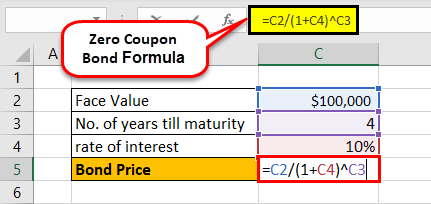

Zero Coupon Bond Formula And Calculator Excel Template

Quick Guide On Bond Prices And Formula Bond Calculator Pricing Market Consensus

Current Yield Formula Calculator Examples With Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

Excel Formula Bond Valuation Example Exceljet

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

Yield To Call Ytc Bond Formula And Calculator Excel Template

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Yield Calculator

Bond Yield Formula Calculator Example With Excel Template

How To Calculate Bond Price In Excel

How To Calculate Bond Price In Excel

An Introduction To Bonds Bond Valuation Bond Pricing

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate The Current Price Of A Bond Youtube